US stocks fell on Tuesday, ending a six-day winning streak for the S&P 500, as losses in Big Tech weighed on major indexes.

The S&P 500 declined 0.4% while the Dow Jones lost 114.83 points. Nasdaq closed 0.4% lower.

Alphabet and Amazon both fell more than 1%, while Apple and Nvidia dropped about 0.9% each.

The stock market has mostly been placid in recent days, shrugging off concerns about fallout from Trump’s trade policies. Even after he walked back his aggressive “Liberation Day” tariffs, most US trading partners still face a 10% baseline levy. Many economists expect those tariffs to ripple through into price increases and slower growth.

Much of the drama of recent days has taken place in the bond market, stoked by concerns about a huge tax-and-spending bill that is expected to add trillions of dollars to the national debt and a downgrade of the US debt last Friday by Moody’s Ratings.

The 10-year Treasury yield rose to 4.479% on Tuesday, in its second consecutive daily increase, as investors have shed longer-term government debt. The 30-year yield, which is even more sensitive to perceptions of the country fiscal health, rose to 4.967% on Tuesday.

“The bond market is going to be watching very carefully what happens in Congress this week,” said Carol Schleif, chief market strategist of BMO Private Wealth.

Shares of Home Depot fell 0.6% after the retailer missed quarterly profit expectations and said it would work to keep prices steady despite tariffs. That stood in contrast to Walmart, which signaled last week that its customers would face tariffs-related price hikes, an announcement that provoked criticism from President Trump.

Overseas, policymakers sought to shelter their economies from the tariff fallout. Australia’s central bank on Tuesday cut rates to a two-year low. In China, banks lowered benchmark loan rates, tracking earlier easing by the People’s Bank of China.

Major allies sent Israel a sharp warning

The New York Times, May 21, 2025

Britain said yesterday that it was suspending trade talks with Israel over its plan to escalate the war in Gaza and its blockade of humanitarian aid to Palestinians already at risk of famine. On Monday, Britain, France and Canada demanded that Israel stop this “wholly disproportionate” escalation.

Their appeal amounted to the sharpest condemnation yet from some of Israel’s most powerful supporters since the war began 19 months ago. The message made clear that Israel’s conduct of the war, the high death toll and the abysmal humanitarian conditions were pushing the allies to the limits of what they would tolerate.

“If Israel does not cease the renewed military offensive and lift its restrictions on humanitarian aid, we will take further concrete actions in response,” Britain, France and Canada warned in a joint statement.

Israel’s prime minister, Benjamin Netanyahu, responded by saying that the three countries had handed Hamas “a huge prize,” and accused them of encouraging a repeat of the Oct. 7 attacks that started the war.

Waning U.S. support? The U.S., Israel’s most powerful patron, has not publicly criticized the renewed Israeli offensive. But President Trump has increasingly bypassed Netanyahu, and he skipped Israel on his trip to the Middle East last week.

Warning about aid: A senior U.N. humanitarian official, Tom Fletcher, told the BBC yesterday that 14,000 babies in Gaza could die in the next 48 hours unless truckloads of aid could enter.

Ukrainians are bracing for a longer war

The New York Times, May 21, 2025

After a two-hour phone call with President Vladimir Putin, Trump appears to be stepping back from trying to end the war in Ukraine. For many Ukrainians, that means the devastating war will rage on with no end in sight.

The call on Monday capped a chaotic effort that few in Ukraine believed had any chance as long as the Trump administration refused to apply pressure on Moscow. “America and Russia are playing a dirty and bloody game,” Liliia Zambrovska, a pharmacist in Dnipro, said. But, she added, Ukraine would fight on “because our future belongs to us alone.”

Analysis: Putin has held firm against pressure to agree to an immediate cease-fire. But that diplomatic victory could undermine, or at the very least delay, his broader goal of normalizing relations with the U.S. Trump has said that renewed economic ties with Russia would come after peace in Ukraine, not before.

Sanctions: The E.U. yesterday agreed to ramp up economic pressure on Moscow by targeting its “shadow fleet” of oil tankers that Russia uses to covertly transport and sell its oil. European officials said more such measures were on the way.

China’s military got a boost from the Pakistan-India fight

The New York Times, May 21, 2025

Pakistan said it shot down multiple Indian fighter jets during the four-day conflict with India this month, a claim that resonated as far away as Beijing and Taiwan. The jets that Pakistan used were Chinese-made.

Beijing has not confirmed Pakistan’s claim, and India hasn’t confirmed losing any jets. But in China, state media and commentators praised the performance of the new aircraft.

My take: Various reports have confirmed that Pakistan using China-made Jian-10C fighter jet shot down 6 units of India’s fighter jets and drones supplied by France and Israel. The battle outcome has been downplayed by the US and India.

The US has ordered India not to use its F16 fighter jet in the battle with Pakistan, which now proves to be a wise decision. France is trying hard to explain that its biaofeng fighter jet is not weaker than the China-made Jian-10C, but India had not used it with the right tactics.

JPMorgan upgrades emerging market equities as Sino-US trade war eases

Reuters, May 19, 2025

JPMorgan upgraded its rating on emerging market equities to "overweight" from "neutral" on Monday, citing easing US-China trade tensions and a softer dollar.

Last week, the US and China agreed to a 90-day tariff reduction, with the US cutting duties on Chinese goods to 30% from 145% and China lowering tariffs on US imports to 10% from 125%, fuelling hopes of easing global trade tensions.

"De-escalation on US-China trade front reduces one significant headwind for EM equities," JPM analysts said in a note, adding that the stocks would be further helped by a weakening of the greenback in the second half of this year.

JPMorgan remains positive on India, Brazil, the Philippines, Chile, the UAE, Greece, and Poland within emerging markets, and sees a promising opportunity in China, particularly in technology stocks.

"While this is unlikely to be the end of trade noise, we think that the worst of it is likely behind us," the Wall-Street brokerage added.

The MSCI emerging markets stock index is up 9% so far this year, as confidence in US assets, including the safe-haven dollar, has weakened amid concerns over President Donald Trump's erratic and aggressive policies.

The dollar index is down 7.5% so far this year.

EM equities have lagged developed markets by a cumulative 40% since 2021, according to the brokerage.

Stock valuations now look attractive as they trade at 12.4 times its 12-month forward earnings compared to developed markets' 19.1, JPM said.

China’s central bank cuts two key rates to historic lows

MSN news, May 20, 2025

China’s central bank on Tuesday cut two key interest rates to historic lows, as Beijing battles to stimulate its economy amid seesaw trade tensions with the US.

Beijing and Washington have been locked in a bruising trade war but last week agreed to slash sweeping tariffs on each other’s goods for 90 days.

The deterioration in trade ties has come as China’s economy already faces persistent headwinds from a long-term domestic spending slump, a protracted debt crisis in the property sector and high youth unemployment.

The People’s Bank of China said Tuesday that the one-year Loan Prime Rate (LPR), the benchmark for the most advantageous rates lenders can offer to businesses and households, would be cut from 3.1% to 3.0%.

The five-year LPR, the benchmark for mortgage loans, was cut from 3.6% to 3.5%, it said.

Both rates were last cut in October to what were then record lows.

“The rate cuts will reduce interest payments on existing loans, taking some pressure off indebted firms. It will also reduce the price of new loans,” Zichun Huang, China economist at Capital Economics, said in a note.

“But modest rate cuts alone are unlikely to meaningfully boost loan demand or wider economic activity,” she said.

“Today’s reductions… probably won’t be the last this year,” Huang said.

China has set an annual GDP growth target of around 5% for 2025, an aim that analysts say is ambitious given the economic challenges it faces.

However, data for the first quarter was unexpectedly strong, with authorities announcing a 5.4% year-on-year expansion according to preliminary estimates.

‘Complex situation’

Official data on Monday showed China’s factory output grew at a faster rate than expected last month, weathering the trade war with Washington.

Industrial production grew 6.1% year-on-year in April, according to figures published by the National Bureau of Statistics (NBS).

The reading was higher than the 5.7%t forecast in a Bloomberg survey, but still lower than the 7.7% jump recorded for March.

The NBS said the economy “withstood pressure and grew steadily in April,” but acknowledged a “complex situation of increasing external shocks and layered internal difficulties and challenges”.

Other data showed retail sales – a key gauge of domestic demand – grew 5.1% year-on-year last month, short of the 5.8% growth forecast by Bloomberg.

The reading also marked a slowdown from March’s 5.9% growth.

April saw the price of new residential properties contract in 67 out of 70 surveyed cities, reflecting continued consumer caution, according to the data.

Ant Group’s global unit brings in US$3 bil ahead of spinoff

Bloomberg, May 19, 2025

Jack Ma-backed Ant Group Co’s international division generated nearly US$3 billion (RM12.91 billion) in revenue for 2024, according to people familiar with the matter, setting the stage for a spinoff after the unit set up its own board last year.

Ant International, which is headquartered in Singapore, has also produced two consecutive years of adjusted profit, the people said, requesting not to be named because the information isn’t public.

It isn’t clear how the company calculates its adjusted Ebitda but the metric typically strips out non-recurring costs, restructuring charges and other items.

The group as a whole grew profits by 61% in 2024 to RMB38.3 billion (RM22.81 billion), according to Bloomberg calculations based on filings from its affiliate Alibaba Group Holding Ltd. Its latest revenue was not disclosed. Hangzhou-based Ant owns Alipay, a widely used digital payments app and financial services provider in China.

Ant Group didn’t immediately respond to an emailed request for comment.

Ant International has been making inroads into Southeast Asia and expanding its business scope. It’s been a key unit for Ant Group, which has been trying to bolster revenue growth by investing heavily into artificial intelligence and overseas.

The international arm initially catered to Chinese tourists travelling outside the country by enabling them to use Alipay to make payments abroad. That service has since expanded into a backbone for cross-border payments known as Alipay+ that can be used by other digital wallets.

For example, when customers of GCash from the Philippines travel to South Korea, they can make payments with their regular app when they see the Alipay+ logo displayed at merchants. Alipay+ currently connects 1.7 billion user accounts across 36 digital wallets.

Ant International has three other core businesses: Antom offers payment solutions for merchants, WorldFirst enables cross-border trade payment, and Embedded Finance has an AI-powered digital lending service and helps clients with treasury and foreign exchange management.

The unit is overseen by chairman Eric Jing, who is also chairman and CEO of Ant Group. Yang Peng is the CEO of Ant International.

Ant Group has made changes to its overall business strategy since Chinese regulators forced it to scrap its blockbuster initial public offering in 2020.

In 2023, the company proposed buying back as much as 7.6% of its shares under a repurchase plan that took Ant’s valuation down to about US$79 billion at the time — well off its peak of US$280 billion prior to its aborted listing.

Ant overhauled its structure last year and set up independent boards for three of its units including the international division, OceanBase, and Ant Digital Technologies. The overall group would explore going public in Hong Kong first instead of a dual Shanghai-Hong Kong listing like what it tried earlier, people familiar said in 2023.

My take: This should pave the way for a listing of Ant Group, after the failed attempt in 2020. I see that the Ant International division may be the first to be listed, perhaps in Singapore as the HQ is based in the city state. The other two units of Ant Group may go public in Hong Kong as the article above suggests. That would be a re-rating factor for Alibaba stock as the latter owns some 30% in Ant Group and higher stakes in the Ant International division.

Final E-ART route proposal expected by August, Johor state assembly told

Bernama, May 19, 2025

The final alignment proposal for the Elevated Automated Rapid Transit (E-ART) system is expected to be announced in August, the Johor State Legislative Assembly was told on Monday.

State Public Works, Transport, Infrastructure, and Communications Committee chairman Mohamad Fazli Mohamad Salleh said it is subject to the outcome of the request for proposal (RFP) evaluation by the Public-Private Partnership Unit (UKAS).

“UKAS has initiated the RFP process for the E-ART system implementation as part of efforts to complete the integrated transportation network in Greater Johor Bahru.

“The E-ART system will cover three main corridors, namely Skudai, Tebrau and Iskandar Puteri, and will be integrated at the main interchange station at Bukit Chagar, ultimately supporting the Johor Bahru-Singapore Rapid Transit System,” he said at the assembly sitting in Kota Iskandar on Monday.

He was responding to a question from Datuk Ramlee Bohani (Barisan Nasional-Kempas) about the government’s measures to tackle the worsening traffic congestion in Johor Bahru, including short- and long-term plans to address the problem.

He said the E-ART system will significantly ease traffic congestion, improve daily mobility and support the state’s low-carbon agenda.

Mohamad Fazli was previously reported to have announced the development of the E-ART system, which involves 32 stations and is estimated to cost nearly RM7 billion.

He said the state government had set up the Greater JB Special Traffic Dispersal Committee, which had identified 77 congestion areas and taken action in more than 20 locations.

“This committee has also proposed measures such as the installation of lane barriers, traffic information boards, and enforcement during peak hours, which have been presented at the Cabinet Committee Meeting on Congestion and Safety.

“The dispersal plan includes the closure of Jalan Ledang leading to the Skudai Highway (the exit ramp from Taman Johor to Skudai), which has successfully reduced traffic pressure in the area,” he said.

Mohamad Fazli said the government is also studying the need to increase road capacity, including widening roads, building new bypasses, carrying out regular maintenance, and implementing more modern traffic management systems to support future economic growth and traffic density.

“Therefore, the state government has submitted a list of 18 proposed projects to the Highway Network Development Plan consulting services to review projects that should be prioritised for approval,” he added.

My take: This E-ART project was initially proposed by YTL Power as a solution to Johor Bahru public transportation congestion issues. It was later challenged by alternative proposal for a LRT system, instead of an ART system, by rival groups.

Johor state assembly has since carried out feasibility studies into both proposals and found that E-ART system would be the best solution as it would cost much less than a LRT system that would cost over RM13 billion, and would take less time to implement.

YTL Power has submitted a proposal in response to the RFP issued by UKAS, and is seen as the front runner to win the project. I look forward to a favourable RFP evaluation outcome in 2H 2025.

AEON announces Record Pretax Profit for Q1 FY2025

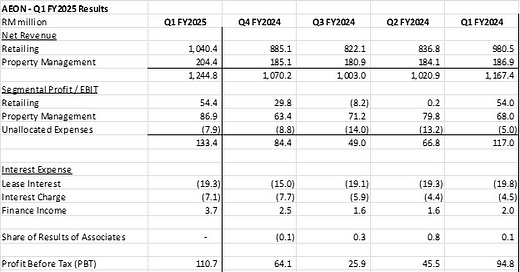

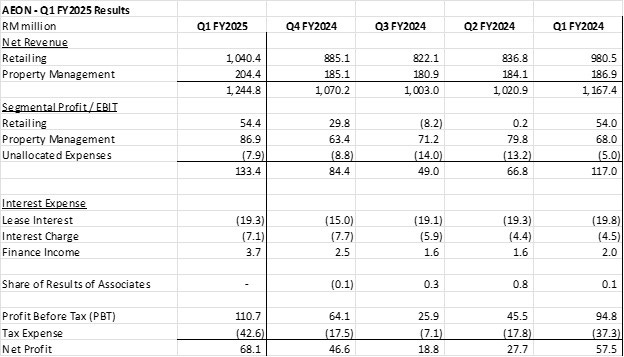

Aeon Bhd announced its Q1 FY2025 result yesterday with a record high quarterly pretax profit. I will analyse its results and compare with my earlier projection last week in the following session. A summary of the quarterly results is tabulated below:

The retails segment registered 6.1% growth in revenue and 1% growth in EBIT. The increase in revenue is due to higher footfalls in several AEON malls that have completed rejuvenation in 2024. The smaller increase in EBIT is probably due to higher operating costs especially after the increase in minimum wage from 1 Feb 2025.

The retails segment EBIT was at RM54.4m, lower than my earlier projection of RM57m, likely due to higher operating costs.

The Property Management segment registered impressive growth of 9.4% y-on-y to RM204.4 million, and I am glad that my earlier projection of RM204.4m was spot on based on an average 6% increase in rental rate and higher occupancy rate of 97% from 94%:

RM186.9m x 97%/94% x 1.06 = RM204.4 million (note that there was an error in my earlier calculation that resulted in a revenue of RM201.1m)

The EBIT for Property Management segment came in at RM86.9m, higher than my earlier projection of RM84.0m. This is a positive surprise.

(Again, there was an error in my earlier calculation of PMS EBIT in that I assumed a 5% increase in operating costs for the entire year, which I should have used the operating costs for a quarter).

Total EBIT came in at RM133.4 million, higher than my earlier estimate of RM132m.

Net interest expenses came in at RM22.7m, slightly higher than my earlier projection of RM20m. The discrepancy was due to the exceptionally low lease interest in Q4 FY24.

Pretax profit came in at RM110.7 million, slightly lower than my earlier projection of RM112 million due to the higher lease interest expense.

Net profit came in at RM68.1 million, much lower than my earlier projection, mainly due to the substantially higher taxation rate of 38.5% in Q1 FY25 (27.3% in Q4 FY24, 27.4% in Q3 FY24, 39.1% in Q2 FY24, 39.3% in Q1 FY24). Such a high taxation rate is unavoidable, it seems, unless AEON adopts a REIT structure to house its AEON malls.

Overall, the performance of AEON in this Q1 is good and should beat the expectation of most analysts. The most important thing is that AEON’s average rental rate does increase by 6% year-on-year, resulting in an increase of 25%-27% in PMS EBIT.

Net cash improved to (RM175 million) as of 31 Mar 2025, from (RM249m) one year ago. Capex was just RM28.6 million in Q1 FY25, but will increase in coming quarters as AEON statement says the company will accelerate renovation projects at selected AEON stores and malls in coming months. AEON though is still projected to turn into a net cash position by the end of this year.

With the satisfactory Q1 results, AEON is on track to achieve a record net profit of close to RM200 million (EPS of 14.2 sen) for FY2025. At the current share price of RM1.51, AEON is trading at forward PER of just 10.6x, a big discount to its 5-year mean PER of 17x and a big discount to peers valuation such as 24x PER for MR DIY and 31x PER for 99 Speed Mart. AEON registered a 18.4% y-on-y growth in net profit, defying most analysts’ bearish view on AEON as a slow-growth retail stock. In comparison, 99 Speed Mart only achieved a net profit growth of 7.5% y-on-y in its Q1 FY25 results. MR DIY achieved a 21.2% y-on-y growth in its Q1 net profit.

I see a continued re-rating of AEON share price towards the 5-year mean PER of 17x, or a target price of RM2.42 by year end.

Over the longer term, AEON will be able to achieve net profit of RM350m (or EPS of 25 sen) in FY2030, with free cashflows of over RM500 million if capex then comes back to just normal maintenance spending of some RM80m a year. AEON would be able to declare dividends of 20 sen or so in FY2030 if the company pays out 55% of its free cash flows as dividends (or 80% payout ratio from net profit).

Hence, AEON is a perfect candidate for long term investments as the business is resilient with steady and foreseeable growth, with strong operating cashflows which may give dividend yields of over 13% every year from 2030.

It is noticeable that EPF has been disposing AEON shares in the open market in past few days, especially when the share price approached RM1.50 level. EPF was seen aggressively paring down AEON stakes in past 2 years from a high of over 13% to now 6.0%. I hope the latest excellent quarterly result will cause EPF to think twice before it dumps more AEON shares.

EPF’s action is sometimes hard to understand, as it was seen selling aggressively YTL and YTL Power shares in late 2023 to early 2024 when the share price more than tripled in the period. EPF was seen buying IOIPG shares when the share price was above RM2.00 in 2024, but is now selling IOIPG shares while the share price is below RM2.00.

I would not suggest anyone to chase high AEON shares today, as historically the stock has not responded well to its good quarterly result due to a lack of support from fund managers and analysts. Furthermore, the next Q2 quarterly results will be seasonally weaker. AEON stock is only for long term investment holds, buy below RM1.50 and you will be rewarded handsomely by 2030.

Net short positions on YTL Power reduced by 1.3 million shares to 24.6m shares at close Tuesday. I expect more shorts on YTL Power to close after the mother share price gets adjusted for the bonus warrants on 27 May. Net short positions on IOIPG creeped up slightly to 16.9 million shares.

Bloomberg reported that "Malaysia declared it'll build a first-of-its-kind AI system powered by Huawei Technologies Co. chips, only to distance itself from that statement a day later, underscoring the Asian nation's delicate position in the US-Chinese AI race."

US claimed that the use of Huawei AI chips could violate US export controls. US probably made the assessment without even having access to the chip yet. But it might have a point that any semiconductor and chip design will have some underlying US company technology, which is off limit to Huawei.

Malaysia needs to handle the situation delicately. To the US, Malaysia either chooses Chinese or US, but not both. So our previous discussion about YTL Power running separate AI data centres based on Nvidia and Huawei chips is unlikely to happen.

I also wonder how US will respond to Malaysia's decision to roll out second 5G on Huawei network by U Mobile.

Could all these, together with the on-going trade negotiations, pose a risk to the future Nvidia's GPU availability?

MrDragon,ytlpower的红股权证和股息,对卖空者有没有影响呢?(例如付额外的利息或要买更多的股票填补回去?)