US stocks rose on Friday, adding to the strong gains for the week, as investors continued to navigate an evolving global trade landscape while major tech names got a boost.

Alphabet rose 1.5% after the Google parent and “Magnificent Seven” name reported a beat on the top and the bottom lines for the first quarter. Tesla popped 9.8%, while fellow megacap names Nvidia and Meta Platforms advanced 4.3% and 2.7% respectively.

Stocks have been taken for a wild ride in recent weeks, as traders try to make sense of the severity of Trump tariffs first unveiled on April 2. Mixed messaging around trade has added to the volatility.

China said Thursday that there were no talks with the US on a potential trade deal. This came after the US appeared to soften its stance on trade tensions with China.

On Friday, Time magazine published comments from Trump that said he would consider it a “total victory” if the US has high tariffs of 20% to 50% on foreign countries a year from now. But his Tuesday comments published Friday also said the president expects announcements on many deals to be coming “over the next three to four weeks”.

Adding to the confusion, Trump told reporters from Air Force One that he would not drop tariffs on China unless “they give us something”.

Still, going forward, Jay Hatfield, founder and chief investment officer of InfraCap, is optimistic that the worst of the tariff-induced uncertainty is over.

“The confusion about whether there’s really talks going on with China or not took some stream out of the market,” he told CNBC in an interview. “Our view is that we’ve reached peak tariff tantrum and so it’s likely to be more positive than negative.”

Hatfield believes the key driver for markets next week will be earnings from big hyperscaler firms such as Microsoft and Amazon.

China mulls lifting tariffs on critical US medical and industrial goods

Bloomberg, April 25, 2025

China’s government is contemplating the suspension of its 125 per cent tariff on certain US imports as economic pressures from the ongoing trade dispute intensify for specific industries, according to sources familiar with the discussions.

This potential policy shift comes as both nations grapple with the economic repercussions of escalating trade tensions, Bloomberg reported.

Among the items being considered for tariff exemptions are medical equipment and industrial chemicals such as ethane, according to people who requested anonymity due to the sensitive nature of the deliberations.

Chinese authorities are also discussing waiving the additional tariff on aircraft leases, which would provide critical relief to Chinese airlines that don’t own all their aircraft and rely on leasing arrangements with third-party companies — payments that would become financially unsustainable with the 125 per cent surcharge.

Financial markets responded quickly to news of the potential exemptions, with the offshore yuan reversing course to post a slight gain of 7.2857 per dollar, erasing Friday morning’s losses of up to 0.1 per cent and underscoring the significance of any potential thaw in the trade war.

China’s contemplated exemptions mirror similar measures recently taken by the United States, which excluded electronics from its 145 per cent tariff on Chinese imports earlier this month.

While the United States imports significantly more from China than vice versa, Beijing’s potential move highlights areas of the Chinese economy that remain dependent on American goods.

China, despite being the world’s largest plastics manufacturer, relies on ethane imports primarily from the US for some of its factories.

Similarly, Chinese hospitals depend on advanced medical equipment such as magnetic resonance imaging and ultrasound machines produced by American companies like GE Healthcare Technologies Inc.

The list of potential exemptions remains fluid and discussions may not progress to implementation. Companies in vulnerable sectors have reportedly been asked by Chinese authorities to submit customs codes for US goods they need exempted from the new tariffs.

At least one Chinese airline has already been notified that payments to aircraft leasing companies located in free trade zones will not be subject to the additional levy, according to one source.

Industry insiders have been circulating purported lists of tariff-exempt customs codes corresponding to key chemicals and chip-making components, though Bloomberg said it could not independently verify these lists.

In related developments, Chinese financial media outlet Caijing reported Friday that Beijing is preparing to waive additional tariffs on at least eight semiconductor-related products, citing anonymous sources. These categories reportedly do not include memory chips at present, potentially disappointing Micron Technology Inc, the world’s third-largest memory chipmaker.

Investors are closely monitoring both nations for signs of engagement that might lead to reduced tariffs, but diplomatic relations appear stalled. Chinese officials publicly said Thursday that the US must revoke all unilateral tariffs before China will agree to trade talks.

Despite President Donald Trump’s attempts to contact President Xi Jinping directly since returning to office, the Chinese leader has thus far resisted, advocating instead for lower-level discussions to work toward an agreement.

For its part, the Trump administration has exempted smartphones, computers, and other electronics from its reciprocal tariffs, providing significant relief to global technology manufacturers including Apple Inc. and Nvidia Corp, though these exemptions may be temporary.

The US exclusions apply to smartphones, laptop computers, hard drives, computer processors, memory chips, and flat-screen displays.

These potential tariff exemptions from both sides suggest that despite the political rhetoric, pragmatic economic considerations may be forcing both governments to reconsider the most damaging aspects of their trade policies, particularly in sectors where domestic industries would suffer disproportionately from continued tariff escalation.

‘He has to be dealt with’: Trump threatens Putin after latest attacks on Ukraine

MSN news, April 26, 2025

Donald Trump has said Vladimir Putin “has to be dealt with” after he accused the Russian President of “tapping me along” over a possible peace deal with Ukraine.

“There was no reason for Putin to be shooting missiles into civilian areas, cities and towns, over the last few days,” Trump wrote on his Truth Social platform, referring to overnight attacks in Dnipropetrovsk Oblast, southeastern Ukraine.

“It makes me think that maybe he (Putin) doesn’t want to stop the war, he’s just tapping me along, and has to be dealt with differently, through “Banking” or “Secondary Sanctions?” Too many people are dying!!!”

Trump’s comments came hours after he met with Volodymyr Zelensky on the sidelines of Pope Francis’s funeral, following the US President’s suggestion that both Ukraine and Russia were “very close” to reaching a peace deal.

Zelensky said he had a “good meeting” with Trump. The two leaders, in their first meeting since the astonishing bust-up in the Oval Office last month, were pictured sitting down face-to-face and on their own in a marble hall of St Peter’s Basilica.

They sat around two feet apart and were leaning in towards each other in conversation. No aids appeared to be immediately involved in the chat.

The Ukrainian President said the discussion was “very symbolic” before the Pope’s funeral, where the two men “discussed a lot one-on-one”.

“Hoping for results on everything we covered,” he said in a post on X. “Protecting lives of our people. Full and unconditional ceasefire. Reliable and lasting peace that will prevent another war from breaking out.”

White House communications director Steven Cheung said the two leaders “met privately today and had a very productive discussion”. He added: “More details about the meeting will follow.”

A spokesman for Zelensky’s office said the two leaders spoke for about 15 minutes and agreed to have a second meeting later on Saturday.

Zelensky’s chief of staff, Andriy Yermak, described the meeting as “constructive”.

The leaders were later pictured meeting with Prime Minister Sir Keir Starmer and France’s President Emmanuel Macron.

Macron’s office said the four leaders held a “positive” meeting on the sidelines of the Pope’s funeral.

The last meeting between Trump and Zelensky saw the Ukrainian President chastised on live television by Vice President JD Vance, marking a dramatic shift in the US’s relationship with Ukraine. Trump also accused the Ukrainian leader of “gambling with world war three”.

Ceasefire close

Trump has been pressing both sides to agree to a ceasefire and has called for a high-level meeting between Kyiv and Moscow to close a deal.

The US President previously warned his administration would walk away from its efforts to achieve a peace if the two sides do not agree a deal soon.

Shortly after arriving in Rome on Friday, Trump said on social media that Ukraine and Russia should meet for “very high-level talks” on ending the three-year war sparked by Russia’s invasion.

His envoy, Steve Witkoff, met Vladimir Putin earlier Friday. Trump said there had been productive talks between his envoy and the Russian leadership.

Arriving at St Peter’s Square for the funeral on Saturday morning, Zelensky was met with cheers and applause. He chose not to wear a suit and instead wore a dark shirt, buttoned up to the neck with no tie, and a dark military-style jacket.

Zelensky, since the start of Russia’s full-scale invasion in 2022, has eschewed suits in favour of military-style attire, saying it is his way of showing solidarity with his countrymen fighting to defend Ukraine.

Trump was accompanied by his wife, First Lady Melania. The US President was also pictured shaking the hand of Macron during the funeral.

The leaders made the gesture when the congregation was invited to offer those around them a “sign of peace” – a traditional part of the Roman Catholic mass.

Ukraine’s view

In a statement on Friday night Zelensky said that “very significant meetings may take place” in the coming days, and that an unconditional ceasefire was needed.

“Real pressure on Russia is needed so that they accept either the American proposal to cease fire and move towards peace, or our proposal – whichever one can truly work and ensure a reliable, immediate, and unconditional ceasefire, and then – a dignified peace and security guarantees,” he said.

“Diplomacy must succeed. And we are doing everything to make diplomacy truly meaningful and finally effective.”

Differences still remain between the position of the Trump White House on peace talks and the stance of Ukraine and its European allies.

Washington is proposing a legal recognition that Crimea, the Ukrainian peninsula annexed by Moscow in 2014, is Russian territory, something that Kyiv and its allies in Europe say is a red line they will not cross.

Trump said on Truth Social this week: “Nobody is asking Zelensky to recognise Crimea as Russian Territory but, if he wants Crimea, why didn’t they fight for it 11 years ago?”

Zelensky maintains that recognising Crimea as part of Russia would violate Ukraine’s constitution and is seeking a full and unconditional ceasefire.

There are also differences on how quickly sanctions on Russia would be lifted if a peace deal was signed, what kind of security guarantees Ukraine would have, and how Ukraine would be financially compensated.

Opportunity for Starmer

The gathering in Rome also offers Stamer the opportunity to raise continued support for Ukraine, and other issues like US tariffs, as he met with Trump and his counterparts from across the globe.

The Prime Minister and Macron are leading efforts to establish a peacekeeping mission that will enforce a possible future ceasefire in Ukraine.

British military figures this week told The Times that the so-called coalition of the willing is now too risky a prospect. Downing Street has brushed aside these claims.

The Telegraph reported the US has privately indicated it is willing to back up European peacekeepers in the face of potential Russian aggression.

William, the Prince of Wales, is also among the leading dignitaries who attended the ceremony in St. Peter’s Square.

Japanese car giant moves manufacturing out of US in tariff twist

Dailymail.com, April 26, 2025

President Donald Trump's tariffs just cost America a chunk of Canadian business. Subaru, which sold 68,043 cars in Canada in 2024, is reshuffling its supply chain in response to escalating car trade scuffles.

The company sold over 17,700 American-built vehicles in Canada last year, making up 26 percent of its 2024 sales. But the Japanese automaker’s Canadian division will slash US imports to just 10 percent by the 2026 model year, representing thousands of cars and millions of dollars lost. The biggest impact will be on the American-built Outback. The popular car will no longer ship north after 2026.

Instead, it will feature a 'made in Japan' badge. Subaru Canada's CEO, Tomohiro Kubota, said the move will 'minimize the impact of the counter surtax,' according to Automotive News Canada. For Subaru, it’s cheaper to build and ship cars out of Japan than deal with the political whiplash of US trade policy.

The Japan-based manufacturer already has plants in its home country, where its supplied Canadian dealerships with high-selling Crosstrek and Forester SUVs. Subaru didn't say if the adjustment will facilitate any production or job changes in Indiana. Previously, the company said the plant will begin assembling the Forester, one of its American best-sellers, later this year. It’s unclear if any of those units will end up crossing the border.

At this year's New York International Auto Show, the company's CEO, Atsushi Osaki, said the brand is committed to staying in the US market. 'We are dedicated to offering our American customers a wide range of options to meet their evolving needs,' Osaki said. Subaru declined to comment on this story.

At the heart of Subaru's shift is a 25 percent import tax that Trump imposed earlier this year on vehicles from nearly every country, including Canada. Lawmakers in Ottawa snapped back with retaliatory tariffs of its own, hitting US-built cars with duties up to 25 percent. Multiple car companies have been caught in the middle. For decades, the US and Canada have enjoyed free trade agreements allowing products to flow over the borders.

American companies, including Stellantis and Ford, built giant factories in Canada, while international automakers built US plants and shipped products up north. Trump's tariffs effectively ripped up the agreements, including the USMCA agreement he renegotiated and signed during his first administration.

The President has consistently said that his trade policies will force automakers to build their vehicles in the US. So far, his tariffs have had a mixed response from automakers. Stellantis attributed a 900-job layoff to the tariffs, Honda announced that the Civic Hybrid will have a final assembly plant in the US, and GM said its ramping up production of its high-priced, American-made pickups.

Volvo also discontinued the S90 sedan from the US market. Multiple US automaker executives told DailyMail.com that American trade wars, combined with Trump's tariff waffling, have made them unsure about how to even set a price for their products.

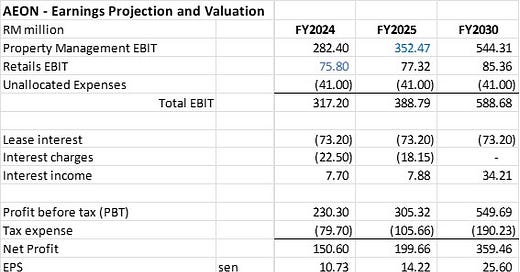

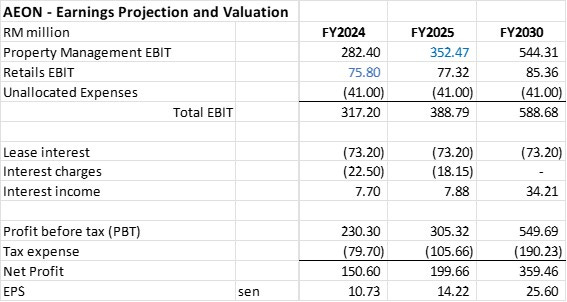

Upwards Revision in AEON Earnings Projection

After reviewing AEON Annual Report 2024, I have made some revisions in AEON earnings projection as follow:

Average occupancy rate in Q4 FY2024 was revised up to about 95% (being the mid point of the average occupancy rate of 93% in Q3 and the latest occupancy rate of 96.9% as stated in Annual Report 2024. As a result, the average rental rate is now calculated at RM4.85 psf/month from the earlier figure of RM4.92 psf/month (which was based on an assumed average occupancy rate of 94%).

As a result, the average occupancy rate for FY2024 is revised to RM4.88 psf/month from the earlier RM4.90 psf/month.

The average occupancy rate for FY2025 is revised to RM5.1728 psf/month, still based on a 6% growth in occupancy rate from RM4.88 psf/month

The total net lettable area (NLA) for FY2025 and FY2030 is revised up slightly to 13.5 million sf as per Annual Report 2024, from the earlier 13.4m sf

The average occupancy rate for FY2025 and FY2030 is revised up to 96.9% as per the latest figure in Annual Report 2024, from the earlier figure of 95%

As a result, AEON’s property management segmental revenue will rise to RM812m for FY2025 and RM1,025m for FY2030

The EBIT for the property management segment will increase to RM352m in FY2025 from the earlier figure of RM335m.

The projected net profit for AEON will rise to almost RM200 million in FY2025, from the earlier figure of RM191m

Earnings per share (EPS) for AEON stock will reach 14.2 sen in FY2025, representing a potential 33% jump in net profit for AEON in FY2025

EPS for AEON stock will reach 25.6 sen in FY2030, or a 139% jump in net profit in 6 years from the FY2024 level, representing a compounded growth rate of 15.6% p.a. from 2024 to 2030.

If AEON can raise the average rental rate by 6% p.a. every year from 2024 to 2030, the company will achieve this kind of impressive compounded growth rate of 15.6% p.a. AEON achieved an impressive 8.3% hike in average rental rate in FY2024 based on my calculations (Annual Report 2024 stated it at 8%).

This will be an impressive growth rate for a retails stock, which almost matches the growth rate of Walmart in 2000s and would fit into the investment criteria for investment legends like Warren Buffet and Peter Lynch.

I need to reiterate that AEON Bhd is a stock for long term investment holds, and not for short term trading purposes. Over the short term, the stock price may be subject to various negative factors, such as the trade war between the US and China and purported selling by call warrant issuer. I was lucky enough to pick up some cheap tickets of AEON towards RM1.30 in early March (suspected selling by a call warrant issuer) and early April (due to Trump tariffs).

The operating cashflows of AEON are very strong, and the company will turn net cash by FY2026 (Maybank research also expects the company to be in net cash position by FY26). As AEON embarks on mall expansions (AEON Mall KL MidTown in FY2026, Ipoh AEON Kinta City in FY2027 and AEON Mall Seremban 2 in FY2027/28), capex will be heavy in these three years, estimated at RM300m in FY25, RM300m in FY26 and RM280m in FY27. If there is no more AEON mall expansion, capex will drop to RM60-80m a year for maintenance and small renovation.

I estimate that from FY2028, AEON will be able to declare much higher dividends after the expansion capex programmes complete. AEON will be able to declare 60% of its free cashflows as dividends from FY2028, up from 46% in FY2024 and estimated 50% in FY2025. Dividends may rise to 18.0 sen in FY2028 and 21.5 sen in FY2030.

If we buy AEON at the current price of RM1.48, the stock offers a dividend yield of 3.0% in FY2025 but will offer much higher dividend yields of 12% in FY2028 and 14.5% in FY2030. For my earlier purchases in past few weeks at RM1.30, this batch of AEON stock will give me dividend yields of 13.8% in FY2028 and 16.5% in FY2030. I shall hold onto these batches of stock for my passive income for the long term.

The point is that AEON is a well-managed company with strong growth in the next few years, anchored by the steady occupancy rates at its 26 AEON Malls across the country. It is also a defensive stock amidst the international trade turmoil out there. Its retails business is supported by the expected higher consumer spending power after the 17%-25% hike in civil servants pay schemes and the various cash subsidy programs by the government, eg. Sumbangan Asas Rahmah (Sara) and MyKasih credits. I got to know these from a post by HafizAjiad98 in i3 forum.

AEON share price has since rebounded strongly to RM1.48 as of Friday. The technical chart readings are now positive: a golden cross has formed both in the SMA lines as well as in MACD. Again, a word of caution: do not chase high.

YTL & YTL Power holding EGM on Monday 28 April

Both YTL and YTL Power will be holding an EGM tomorrow to approve the bonus warrants proposal. Though an approval of the warrant proposal is a foregone conclusion, as YTL and EPF will vote in favor, it may be still good for minority shareholders to attend the EGM, especially those in KL.

Those attending will have a chance to learn first-hand from YTL Power Managing Director any clue on the potential opportunities that he and YTL are seeing. You may also have the opportunity to ask about the rationale of making the warrants non-tradeable, and see if you will be convinced by their explanation.

To me, YTL Power and YTL are another good candidates for long term investment holds. I have already articulated many times on why I am bullish on the companies’ prospects in the next few years. As I wrote before, YTL Power earnings may double up or more by FY2028 from the FY2024 level. Once it is done with the heavy capex program for the AI data centre development in next 3 years or so, YTL Power will see super strong cashflows coming in from FY2028. I calculate that YTL Power will be able to declare dividends of 22 sen in FY2028 for a 30% payout ratio and 36 sen in FY2028 for a 50% payout ratio. Dividends will rise gradually as it receives higher returns from its various investment assets eg. Wessex Waters and Jordan Power.

In my earlier article on YTL, I wrote that once Niseko Village is more developed by 2030-2032 with about 10 hotels / resorts (now we have 5 to 6 already) and some mass-market resort homes at the later stage, the contribution from Niseko alone will enable YTL to declare extra dividends of easily 10-12 sen a year, adding to its stable 5 sen dividend, we may get 15-17 sen dividends every year from YTL from 2030. If YTL Power declares higher dividend payout ratio than 30% (eg. 50%), YTL will then be able to declare even higher or close to 20 sen every year from 2030.

Even if their share prices do not rise to the previous highs of RM5.44 and RM3.90 for YTL Power and YTL respectively, I will be happy to hold onto the shares for long term as they will each yield some 10% or higher dividends to me every year from 2030.

So, do not be disheartened by the short term share price setback for YTL and YTL Power, as long as the business operations are intact and the earnings prospects are good, the share price will rise eventually. Recall in last September when YTL Power share price was hit so badly by the MACC case on 1Bestarinet project. Then I tried to convince fellow investors that the MACC case was just some sabotage by YTL business rivals, and it would get over it soon. But not many people believed, and mocked by fears spread all over by short sellers, many investors dumped their holdings of YTL Power at RM3.00 or below.

I did add some positions on YTL Power at RM3.20 level but it fell further to below RM3.00. I did not add further as I already had heavy holdings from early purchases at RM0.70. If I added more, it would increase my average holding cost to above RM1.00, which I was reluctant to.

Now, we should be getting excited with the prospects of YTL Power, more so after it secured the dark fibre projects in Johor as well as along the 1,600km KTM railway tracks. These 2 fibre projects will contribute hundreds of million of profits a year to YTL Power. Those attending the EGM may ask YTL Power top management about this earnings prospect and see if they will give any earnings guidance.

I know that YTL Power bosses are very particular about company cashflows and cash holdings, as YTL Chairman Tan Sri Francis Yeoh has said before, he would like to see the company holding about USD3 billion of cash at all time, in preparation for any good opportunity that presents itself anytime. YTL Corp had almost RM17 billion of cash and short-term investments as of 31 Dec 2024, and these are unencumbered (meaning that YTL can deploy the cash free of any restriction).

Why is it still raising money, since it already has so much?

That is something investors should ask YTL and YTL Power top management at the EGM tomorrow.

To me, I have full confidence in YTL/YTLP management team to secure the right deals by deploying the money raised from the warrants proposal, as they have demonstrated the ability and vision in sealing good deals for the long-term expansion of the group business operations: Lot10, JW Mariott, The Ritz-Carlton, Sentul landbank (1998), Electranet (2000), Wessex Waters (2002), Jawa Power (2004), PowerSeraya (2008), Jordan Power (2013), Brabazon landbank (2014), Niseko landbank (2018), Kulai landbank & colocation data centre with SEA (2022-2023), AI data centre with Nvidia (2023-2024), Johor-Singapore dark fibre project (2025) and RAC 1,600km railway track fibre project win (2025). The important thing to note is that all these deals are long term assets that have been or will contribute earnings to the YTL group for decades to come.

I will appreciate if anyone attending the EGM tomorrow provides some feedback to us here on anything surprising on the positive or negative side.

Net short positions on YTL Power remained at 27.1 million shares at close Friday.

好期待有明天特别股东大会的最新消息。我也相信杨先生他们是杰出而且可信任的。